Chile’s Central Bank, BCCh, recently reduced the monetary policy rate (TPM) by 75 basis points to 8.25%.

Despite this cut, Chile still has one of the world’s most contractionary TPMs. A report by Scotiabank estimates Chile’s real TPM in December to be 3.75%.

This ranks it among the five highest globally.

In comparison, Chile’s current rate is almost four times higher than its previous neutral real TPM.

This makes it the highest contractionary rate in Latin America and one of the highest worldwide.

The BCCh’s December Monetary Policy Report raised the nominal neutral TPM to 4%, aligning with rising rates in other economies.

This adjustment is part of an annual review process and suggests a minor increase projected by the end of 2025.

The BCCh’s statement indicates economic stabilization and mixed signals in domestic demand.

It shows some recovery in consumption but notes weak investment.

Underlying inflation has been lower than September projections and is expected to converge to 3% by mid-2024.

In the labor market, there’s a continued trend of weakness and pessimism. Coopeuch expects a slight downward correction in the TPM’s central scenario.

The BCCh acknowledged improved financial conditions, including a dovish stance by the Fed and falling long-term external interest rates.

There’s also a noted depreciation of the dollar and a decrease in oil prices.

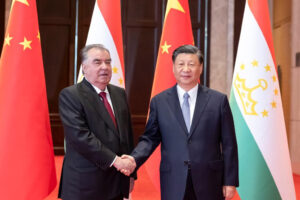

Moreover, the BCCh highlighted better growth projections for China and the U.S., which could provide an external boost.

Scotiabank analysts emphasized the minimal reference to exchange rates in the BCCh’s statement.

Since the last meeting, the peso has appreciated by 8%, outperforming other emerging market currencies and ranking as one of the most appreciated globally.

Source: The Rio Times